Video KYC

Capture and Create Value from Video KYC Solution

Video KYC is an emerging technology where banks, financial services institutions, insurance companies, credit unions, and building societies can engage their customers or members in face-to-face transactions through remote video collaboration sessions. Many institutions plan to use video KYC for enriching the customer/ member experience, improving operational efficiency, or growing revenue. Video KYC further reduces your customer on-boarding time, reduce footfalls at your branches, go-paperless, save cost, and much more.

It further gives flexibility to your customers to complete KYC process while they are at home or in their office via video call without physically visiting your branch which enhances the overall customer experience. The person in-charge of document verification can do a liveliness check along with verification of other aspects such as location, photo, etc., all done over video unlike traditional KYC process where customers were expected to visit their nearest branch with all original documents.

WHY ADOPT VIDEO KYC?

- Some Insights into Financial Services Institutions (Banks, NBFC, Lending Orgs) surveyed

- 82% said that they planning to offer

- 35% – Have deployed or running a pilot

- 20% – Already fully operational services

- An opportunity not to be missed – Consumers love it – most consumers found great value in Video banking and found their first experience compelling

- First-to-market benefits:

- Acquire invaluable experience

- Reap higher rewards

- Gain a competitive advantage

Financial Services Organizations that offer Video KYC Report Impactful ROI.

Better Outcomes

Companies deploying video banking say that the outcomes they are getting much better customer engagement and CSAT ratings

Higher NPS

Those who know about the Net Promoter Score and say that the NPS of video banking is higher or equivalent to the average NPS of other channels.

Higher Sales

Institutions using video banking and KYC have seen at least 36% increase in their sales volumes YoY

Key Features and Functionalities of our Video KYC Software

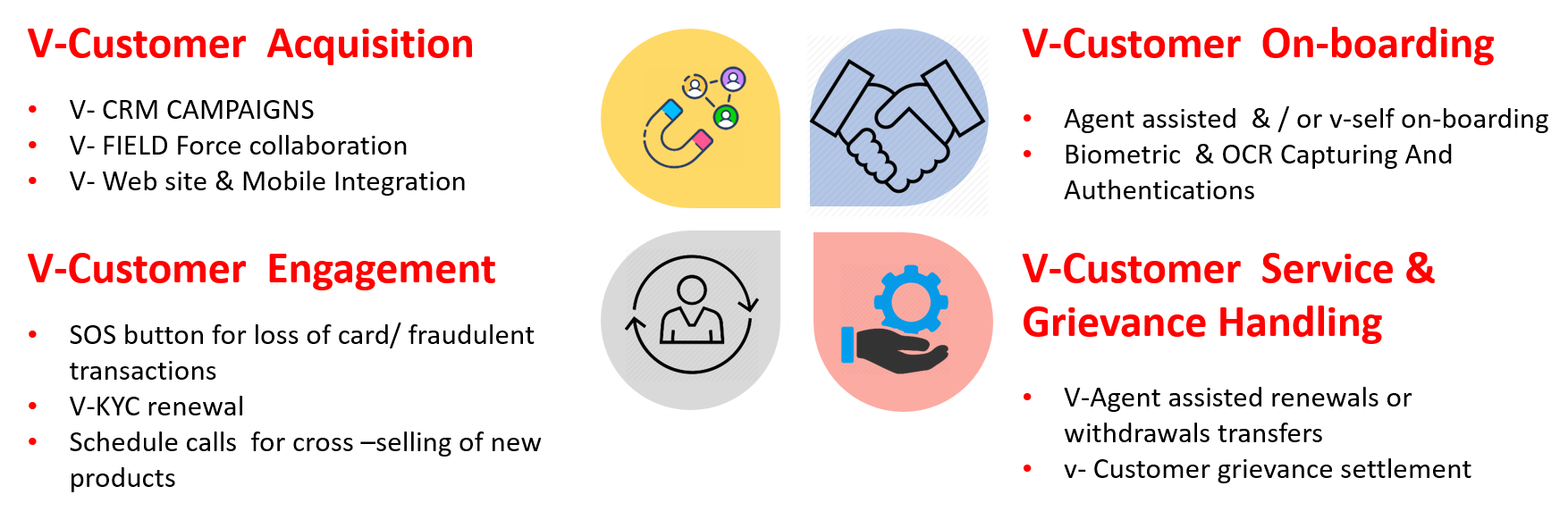

How Intertec can help you transform your business?

- Transforms Customer Acquisitions, Customer Experience, Engagement & TAT with video KYC

- Expand your reach across geography

- Overcomes Capacity & Infra Constraints

- Reduces the Operational Costs

- Improves Operational Efficiency by reducing capacity constraints TTY & TTC

- Diminish all communication challenges by improved understanding

Industry Use Cases

Lending Division

Offers greater customer/ member convenience and streamline the lending process from end to end

Contact Center Team

Provides more personal, interactive support to users of banking websites, mobile apps, ATMs, and ITMs

Distribution Team

Offers access to more resources in smaller branches and load balance across the entire branch network

Private Banking

Wealth management and commercial management can enrich the day-to-day relationships with their clients

Watch the video KYC solution in action. Request for a demo.

Our video KYC and Co-browsing solution helps BFSI and other organizations get rid of legacy processes. With our video KYC solution, your agents can get on a video call with your customers, and capture and verify all their details online without any need of your customer to walk-in to any of your physical branches.