Launching and managing insurance products on legacy systems is a cumbersome, multi-week process that incurs high costs and delays, hindering competitiveness in today’s fast-paced insurance market.

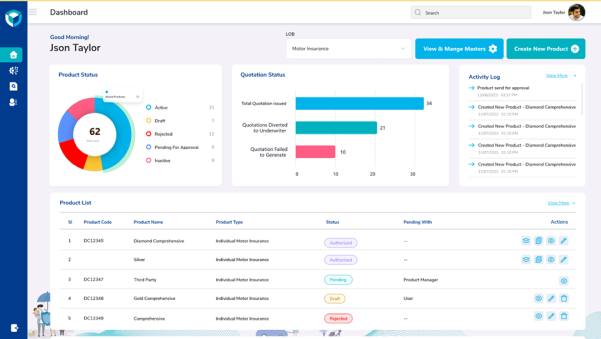

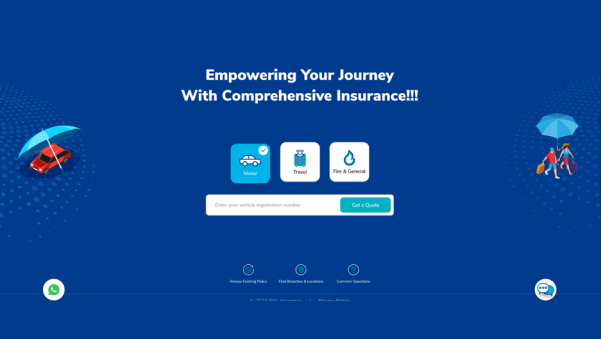

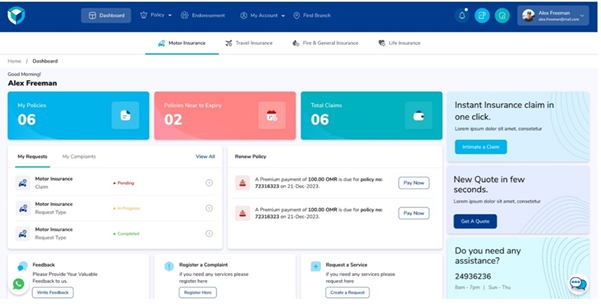

Product Launch Platform (PLP) is designed to address these issues head-on. Our innovative platform empowers insurers to rapidly create, customize, and deploy insurance products across any line of business. With PLP, business teams can swiftly design and modify products, simulate user interactions and quote calculations with advanced tools, and roll out products in minutes.